"Understanding VA Home Loan Rates 2023: A Comprehensive Guide for Veterans and Active Duty Service Members"

#### VA Home Loan Rates 2023As we navigate through 2023, understanding the intricacies of VA home loan rates is crucial for veterans and active duty service……

#### VA Home Loan Rates 2023

As we navigate through 2023, understanding the intricacies of VA home loan rates is crucial for veterans and active duty service members looking to purchase a home. The VA loan program, established by the U.S. Department of Veterans Affairs, offers significant benefits, including competitive interest rates, no down payment requirements, and no private mortgage insurance (PMI).

#### The Importance of VA Home Loan Rates

VA home loan rates in 2023 are influenced by various factors, including the overall economic landscape, inflation rates, and the Federal Reserve's monetary policy. For veterans, securing a favorable interest rate can lead to substantial savings over the life of the loan. A lower rate means lower monthly payments, which can be particularly beneficial for those on a fixed income or transitioning to civilian life.

#### Current Trends in VA Home Loan Rates 2023

As of 2023, VA home loan rates have shown a mix of stability and slight fluctuations. It's essential for potential borrowers to stay informed about these trends. Many lenders are offering rates that are competitive with conventional loans, making it an excellent time for veterans to consider their options. Rates can vary based on credit scores, loan amounts, and the lender's policies, so it's advisable to shop around and compare offers.

#### How to Secure the Best VA Home Loan Rates in 2023

To secure the best VA home loan rates in 2023, veterans should take several proactive steps:

1. **Check Your Credit Score**: A higher credit score can significantly impact the interest rate you receive. It's advisable to check your credit report for any inaccuracies and work on improving your score before applying for a loan.

2. **Get Pre-Approved**: Before house hunting, obtaining a pre-approval letter from a lender can give you a clear picture of your budget and strengthen your negotiating position when making an offer.

3. **Compare Lenders**: Not all lenders offer the same rates or terms. Take the time to compare multiple lenders and their offers to find the best deal.

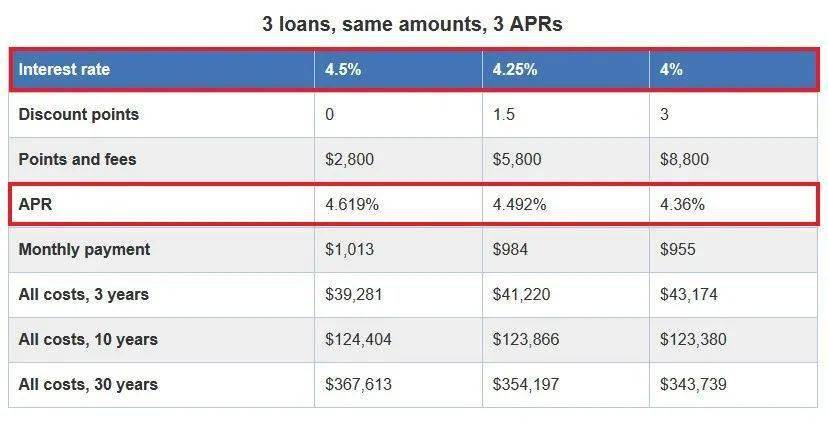

4. **Consider Points**: Some lenders allow you to pay points upfront to lower your interest rate. This can be a wise investment if you plan to stay in the home for a long time.

5. **Stay Informed**: Keep an eye on economic trends and interest rate forecasts. Being informed can help you decide the best time to lock in a rate.

#### Conclusion

In conclusion, understanding VA home loan rates in 2023 is vital for veterans and active duty service members seeking to make informed decisions about homeownership. By staying informed about current trends, understanding how to secure the best rates, and taking proactive steps in the loan application process, veterans can maximize their benefits under the VA loan program. This not only enhances their financial stability but also contributes to their overall well-being as they transition into civilian life. Whether you're a first-time homebuyer or looking to refinance, the VA loan program remains a powerful tool for those who have served our country.