Discover Affordable Loans in Orangeburg, SC: Your Ultimate Guide

Guide or Summary:Understanding Loans in Orangeburg, SCTypes of Loans AvailableHow to Apply for Loans in Orangeburg, SCBenefits of Loans in Orangeburg, SCWhe……

Guide or Summary:

- Understanding Loans in Orangeburg, SC

- Types of Loans Available

- How to Apply for Loans in Orangeburg, SC

- Benefits of Loans in Orangeburg, SC

When it comes to securing financial assistance, loans orangeburg sc stands out as a vital resource for residents in the area. Whether you need funds for unexpected expenses, home improvements, or educational pursuits, understanding your options can make a significant difference in your financial stability.

Understanding Loans in Orangeburg, SC

In Orangeburg, South Carolina, various lending institutions offer a range of loan products tailored to meet the needs of different borrowers. From traditional banks to credit unions and online lenders, the choices can be overwhelming. However, it’s crucial to explore all available options to find the best fit for your financial situation.

Types of Loans Available

1. **Personal Loans**: These are unsecured loans that can be used for various purposes, such as consolidating debt or covering medical expenses. Personal loans in Orangeburg typically come with fixed interest rates and flexible repayment terms.

2. **Auto Loans**: If you’re looking to purchase a vehicle, auto loans are specifically designed for that purpose. Many local dealerships in Orangeburg partner with financial institutions to offer competitive rates.

3. **Home Loans**: For those looking to buy or refinance a home, mortgage loans are available through several lenders in the area. Understanding the different types of mortgages—such as fixed-rate and adjustable-rate mortgages—can help you make an informed decision.

4. **Business Loans**: Entrepreneurs in Orangeburg can access various business loans to help start or expand their ventures. These loans can cover everything from equipment purchases to working capital.

How to Apply for Loans in Orangeburg, SC

Applying for a loan in Orangeburg is a straightforward process, but it requires careful preparation. Here are some steps to guide you:

1. **Check Your Credit Score**: Before applying for any loan, it’s essential to know your credit score. A higher score can qualify you for better interest rates and terms.

2. **Research Lenders**: Take the time to research different lenders in Orangeburg. Compare interest rates, fees, and customer reviews to find the best option.

3. **Gather Necessary Documents**: Lenders typically require documentation such as proof of income, employment history, and identification. Having these ready can speed up the application process.

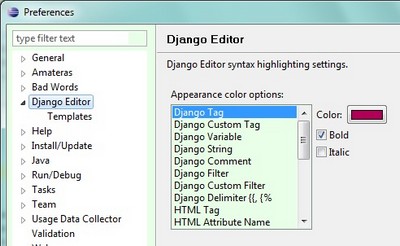

4. **Submit Your Application**: Once you’ve chosen a lender, fill out the application form, either online or in person. Be honest and thorough in your responses to avoid any delays.

5. **Review Loan Terms**: If approved, carefully review the loan terms before signing. Make sure you understand the interest rate, repayment schedule, and any fees involved.

Benefits of Loans in Orangeburg, SC

Obtaining a loan can provide numerous benefits, including:

- **Financial Flexibility**: Loans can offer the financial cushion needed during emergencies or significant life events.

- **Credit Building**: Successfully repaying a loan can help improve your credit score, making it easier to secure future financing.

- **Investment Opportunities**: Whether it’s investing in education or starting a business, loans can provide the necessary capital to achieve your goals.

In summary, loans orangeburg sc represent a valuable opportunity for individuals seeking financial assistance. By understanding the types of loans available, the application process, and the benefits they offer, you can make informed decisions that align with your financial goals. Always remember to borrow responsibly and ensure that you can meet the repayment obligations to maintain your financial health.