Dental Practice Loans: Unlocking Financial Opportunities for Your Dental Practice

Guide or Summary:Understanding Dental Practice LoansTypes of Dental Practice LoansBenefits of Dental Practice LoansHow to Secure Dental Practice LoansWhen i……

Guide or Summary:

- Understanding Dental Practice Loans

- Types of Dental Practice Loans

- Benefits of Dental Practice Loans

- How to Secure Dental Practice Loans

When it comes to running a successful dental practice, financial considerations play a crucial role. One of the most effective ways to secure the necessary funding is through dental practice loans. These specialized loans are designed to meet the unique needs of dental professionals, providing the capital required to grow, upgrade, or sustain a dental practice.

Understanding Dental Practice Loans

Dental practice loans are tailored financial products aimed specifically at dental practitioners. They can be used for various purposes, including purchasing new equipment, renovating office space, expanding your practice, or managing operational costs. The beauty of these loans lies in their flexibility; they can be structured as short-term or long-term financing, depending on the specific needs of the practice.

Types of Dental Practice Loans

There are several types of dental practice loans available to practitioners:

1. **Equipment Financing**: This type of loan is specifically designed for purchasing dental equipment, such as chairs, X-ray machines, or sterilization tools. The equipment itself often serves as collateral, making it easier to secure financing.

2. **Practice Acquisition Loans**: If you're looking to buy an existing dental practice, these loans can provide the necessary funding. They often cover the purchase price and may include working capital to help transition the business.

3. **Working Capital Loans**: These loans are intended to cover day-to-day operational expenses, such as payroll, rent, and utilities. They are crucial for maintaining cash flow, especially during slower months.

4. **Real Estate Loans**: For those looking to purchase or refinance a dental office space, real estate loans offer competitive rates and terms tailored to dental practitioners.

Benefits of Dental Practice Loans

The advantages of dental practice loans are manifold. First and foremost, they provide the financial support necessary for growth and sustainability. With access to capital, dental professionals can invest in the latest technology, which can enhance patient care and improve practice efficiency.

Moreover, these loans often come with favorable terms, including lower interest rates and longer repayment periods, making them more manageable for busy practitioners. Additionally, lenders specializing in dental practice loans understand the industry, allowing for a smoother application process and better support throughout the loan term.

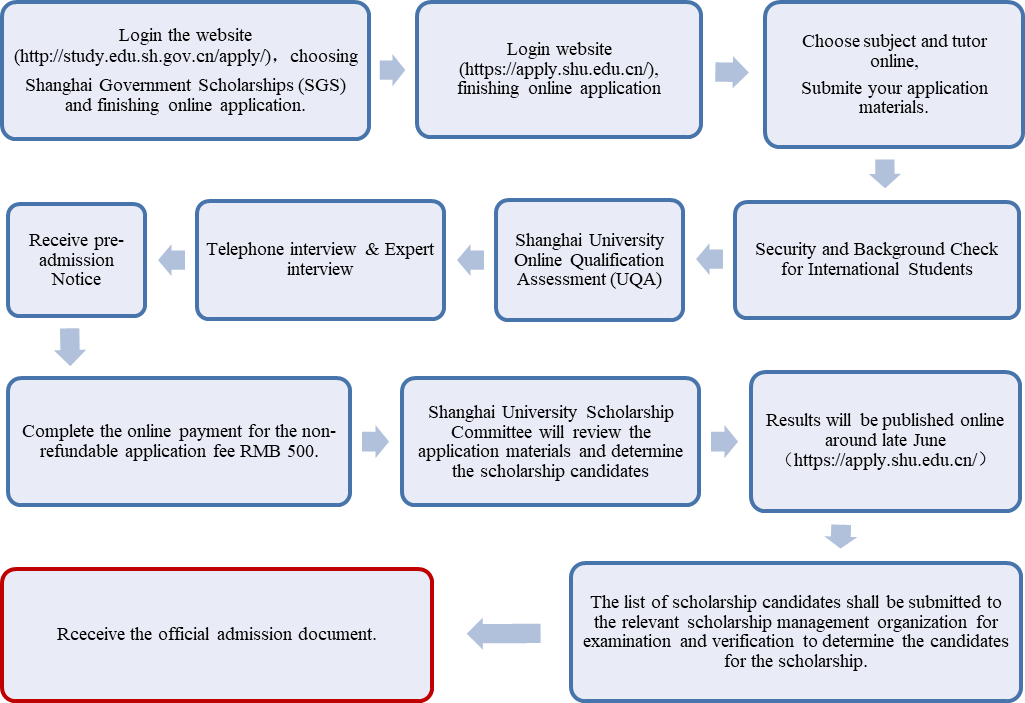

How to Secure Dental Practice Loans

Securing dental practice loans involves several steps:

1. **Assess Your Financial Needs**: Before applying, determine how much funding you need and what you plan to use it for. This will help you choose the right type of loan.

2. **Gather Documentation**: Lenders typically require financial statements, tax returns, and a business plan. Having these documents ready can expedite the application process.

3. **Research Lenders**: Not all lenders are created equal. Look for those who specialize in dental practice loans and have a track record of working with dental professionals.

4. **Submit Your Application**: Once you’ve chosen a lender, submit your application along with the required documentation. Be prepared to discuss your practice's financial history and future plans.

5. **Review Offers**: If approved, review the loan terms carefully. Pay attention to interest rates, repayment periods, and any fees involved.

In the competitive world of dentistry, having access to dental practice loans can be a game-changer. Whether you're looking to expand your practice, upgrade your equipment, or manage day-to-day expenses, these loans provide the financial support necessary to achieve your goals. By understanding the types of loans available and following the proper steps to secure funding, dental professionals can unlock new opportunities and ensure the long-term success of their practices. Embrace the potential that dental practice loans offer and take your dental practice to the next level.