Can You Get a Home Loan with Credit Card Debt? Understanding Your Options and Strategies

#### Can you get a home loan with credit card debt?When it comes to financing your dream home, many potential buyers often wonder: **can you get a home loan……

#### Can you get a home loan with credit card debt?

When it comes to financing your dream home, many potential buyers often wonder: **can you get a home loan with credit card debt?** The answer is yes, but there are several factors to consider that can impact your eligibility and the terms of the loan. This article will explore the relationship between credit card debt and home loans, providing insights and strategies for those navigating this financial terrain.

#### Understanding Credit Card Debt

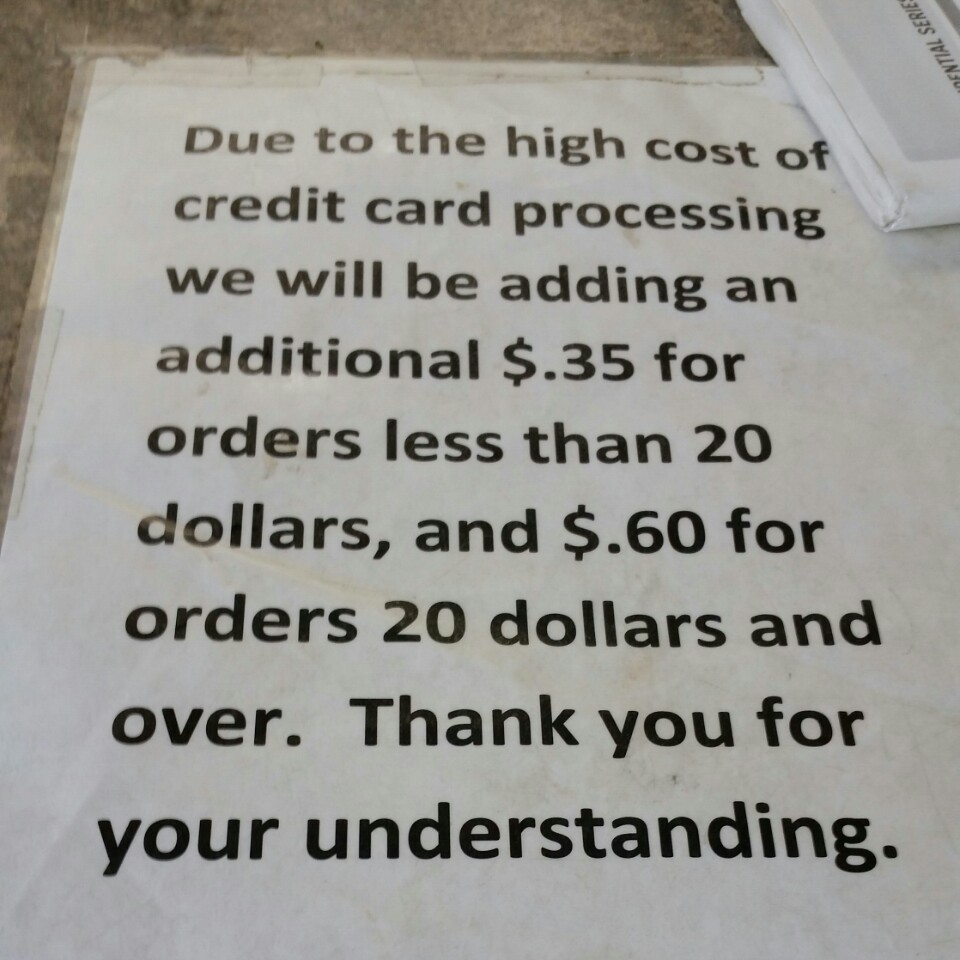

Credit card debt is a common financial challenge faced by many individuals. It typically has higher interest rates compared to other forms of debt, which can make it more burdensome over time. Lenders assess your creditworthiness based on various factors, including your credit score, debt-to-income ratio, and overall financial health. When you apply for a home loan, your credit card debt will be scrutinized alongside other debts you may have, such as student loans or car payments.

#### The Impact of Credit Card Debt on Your Home Loan Application

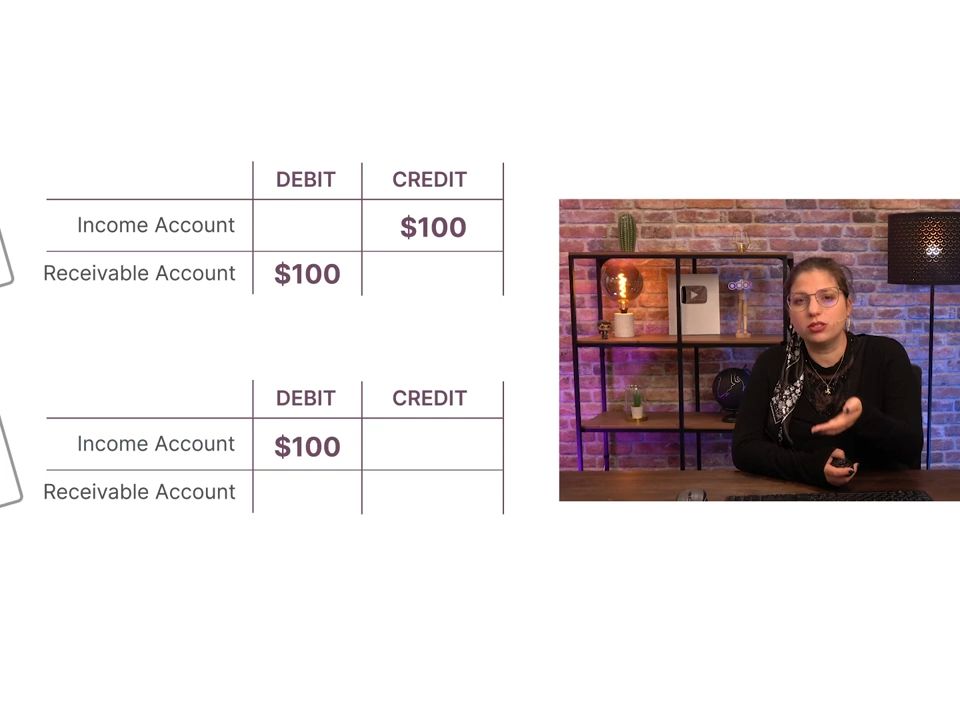

1. **Credit Score**: Your credit score plays a crucial role in determining your eligibility for a home loan. High credit card balances can negatively affect your credit utilization ratio, which is a significant factor in your credit score. A lower credit score may lead to higher interest rates or even denial of your mortgage application.

2. **Debt-to-Income Ratio**: Lenders typically look for a debt-to-income (DTI) ratio of 43% or lower. This ratio compares your monthly debt payments to your gross monthly income. If your credit card debt is high, it can increase your DTI, making it more challenging to qualify for a mortgage.

3. **Loan Type**: Different types of loans have varying requirements. For instance, FHA loans may be more lenient regarding credit scores and DTI ratios compared to conventional loans. If you have credit card debt but a strong income and a good credit score, you may still qualify for certain loan types.

#### Strategies to Improve Your Chances

If you're concerned about your credit card debt affecting your ability to secure a home loan, consider the following strategies:

1. **Pay Down Debt**: Before applying for a mortgage, work on reducing your credit card balances. Paying down debt not only improves your credit utilization ratio but also lowers your DTI, enhancing your overall financial profile.

2. **Increase Your Income**: If possible, look for ways to increase your income through side jobs or overtime. A higher income can help offset your debt and improve your DTI ratio.

3. **Consider a Co-Signer**: If your credit card debt is significantly impacting your credit score or DTI, consider asking a family member or friend with a strong financial background to co-sign your mortgage application. This can improve your chances of approval and potentially secure better loan terms.

4. **Consult a Financial Advisor**: If you're unsure about your financial situation, consulting with a financial advisor can provide personalized guidance. They can help you create a plan to manage your debts and improve your creditworthiness before applying for a home loan.

#### Conclusion

In conclusion, the question **can you get a home loan with credit card debt?** is not a straightforward yes or no. While it is possible, your credit card debt will influence various aspects of your mortgage application. By understanding the implications of your debt, improving your financial situation, and exploring different loan options, you can enhance your chances of securing a home loan despite having credit card debt. Remember, the key is to be proactive and informed as you embark on your home-buying journey.