Discover the Best Options for Loans with Collateral Near Me

Guide or Summary:What Are Collateral Loans?Benefits of Loans with Collateral Near MeWhere to Look for Collateral LoansWhat to Consider Before Applying#### I……

Guide or Summary:

- What Are Collateral Loans?

- Benefits of Loans with Collateral Near Me

- Where to Look for Collateral Loans

- What to Consider Before Applying

#### Introduction to Loans with Collateral Near Me

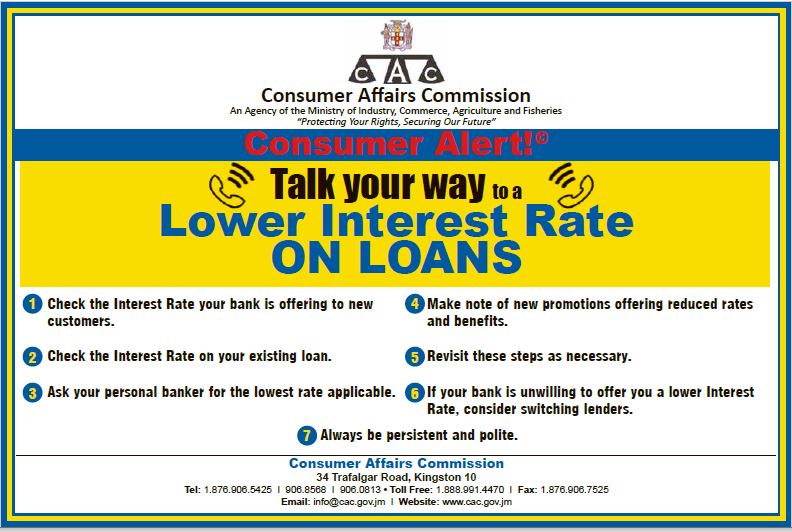

When looking for financial assistance, many individuals consider various types of loans. One popular option is **loans with collateral near me**. These loans require borrowers to provide an asset as security against the loan amount. The collateral can be anything of value, such as a car, property, or savings account. This arrangement often leads to lower interest rates and better terms compared to unsecured loans.

#### Understanding Collateral Loans

What Are Collateral Loans?

Collateral loans are secured loans where the borrower pledges an asset to the lender. If the borrower defaults on the loan, the lender has the right to seize the collateral. This reduces the risk for lenders, allowing them to offer more favorable terms. Common types of collateral include real estate, vehicles, and other valuable items.

Benefits of Loans with Collateral Near Me

1. **Lower Interest Rates**: One of the most significant advantages of loans with collateral is the lower interest rates. Since the lender has security, they are more willing to offer competitive rates, making borrowing more affordable.

2. **Higher Loan Amounts**: Collateral loans often allow borrowers to access larger sums of money. The value of the collateral can determine the loan amount, giving borrowers the opportunity to secure the funds they need for larger purchases or projects.

3. **Easier Approval Process**: With collateral backing the loan, lenders may have a more straightforward approval process. This can be particularly beneficial for individuals with less-than-perfect credit scores.

4. **Flexible Terms**: Many lenders offer flexible repayment terms for collateral loans. Borrowers can often choose the duration of the loan, making it easier to fit repayments into their budgets.

#### Finding Loans with Collateral Near Me

Where to Look for Collateral Loans

When searching for **loans with collateral near me**, there are several avenues to explore:

1. **Local Banks and Credit Unions**: These institutions often provide personal loans secured by collateral. Visiting a local branch can give you personalized service and the opportunity to discuss your financial situation with a loan officer.

2. **Online Lenders**: Many online platforms specialize in secured loans. They may offer quick applications and fast funding, making them a convenient option for those who need money urgently.

3. **Peer-to-Peer Lending**: This alternative lending model connects borrowers directly with individual investors. Some platforms allow for secured loans, providing another option for those looking for collateral-backed financing.

4. **Title Loan Companies**: If you own a vehicle, title loan companies can provide quick cash based on the value of your car. However, it's crucial to read the terms carefully, as these loans can come with high-interest rates.

#### Tips for Securing a Loan with Collateral

What to Consider Before Applying

Before applying for a loan with collateral, consider the following:

1. **Assess the Value of Your Collateral**: Ensure that the asset you plan to use as collateral holds sufficient value to secure the loan amount you need.

2. **Research Lenders**: Compare interest rates, terms, and fees from various lenders. Look for reviews and testimonials to gauge the lender's reputation.

3. **Understand the Risks**: Remember that using collateral means risking your asset. Make sure you can afford the repayments to avoid losing your collateral.

4. **Prepare Documentation**: Be ready to provide documentation regarding your collateral, such as ownership papers or appraisals, to streamline the application process.

#### Conclusion

In conclusion, **loans with collateral near me** can be an excellent option for individuals seeking financial assistance. They offer lower interest rates, higher loan amounts, and easier approval processes. By understanding the benefits and risks associated with collateral loans, you can make informed decisions and find the right loan to meet your needs. Whether you choose to go through a local bank, an online lender, or a peer-to-peer platform, thorough research and preparation are key to securing the best possible terms for your loan.