"Step-by-Step Guide on How to Successfully Wells Fargo Apply for Loan: Tips and Requirements"

Guide or Summary:Step 1: Determine Your Loan TypeStep 2: Check Your Credit ScoreStep 3: Gather Necessary DocumentationStep 4: Complete the ApplicationStep 5……

Guide or Summary:

- Step 1: Determine Your Loan Type

- Step 2: Check Your Credit Score

- Step 3: Gather Necessary Documentation

- Step 4: Complete the Application

- Step 5: Review Loan Offers

- Step 6: Finalize the Loan

#### Introduction

When considering a loan, many individuals turn to reputable financial institutions like Wells Fargo. If you're looking to understand the process of how to **Wells Fargo apply for loan**, you're in the right place. This guide will walk you through the necessary steps, tips, and requirements to ensure a smooth application process.

#### What is a Loan?

A loan is a sum of money borrowed from a lender that is expected to be paid back with interest. Loans can be used for various purposes, including purchasing a home, financing education, or consolidating debt. Understanding the type of loan you need is the first step in the application process.

#### Why Choose Wells Fargo?

Wells Fargo is one of the largest banking institutions in the United States, known for its wide range of financial products and services. They offer various loan options, including personal loans, home equity loans, and mortgages. Choosing Wells Fargo means you are working with a trusted institution that has a long-standing reputation for customer service and support.

#### Steps to Wells Fargo Apply for Loan

Step 1: Determine Your Loan Type

Before you begin the application process, it’s important to determine what type of loan you need. Wells Fargo offers several options, including:

- Personal Loans

- Home Loans

- Auto Loans

- Student Loans

Each type of loan has different requirements and terms, so understanding your needs will help streamline the process.

Step 2: Check Your Credit Score

Your credit score plays a crucial role in the loan approval process. Lenders like Wells Fargo typically require a good credit score to qualify for the best rates. Before applying, check your credit report for any discrepancies and take steps to improve your score if necessary.

Step 3: Gather Necessary Documentation

When you decide to **Wells Fargo apply for loan**, you’ll need to provide specific documentation, including:

- Proof of identity (e.g., driver's license, passport)

- Proof of income (e.g., pay stubs, tax returns)

- Employment verification

- Financial statements (e.g., bank statements)

Having these documents ready will expedite the application process.

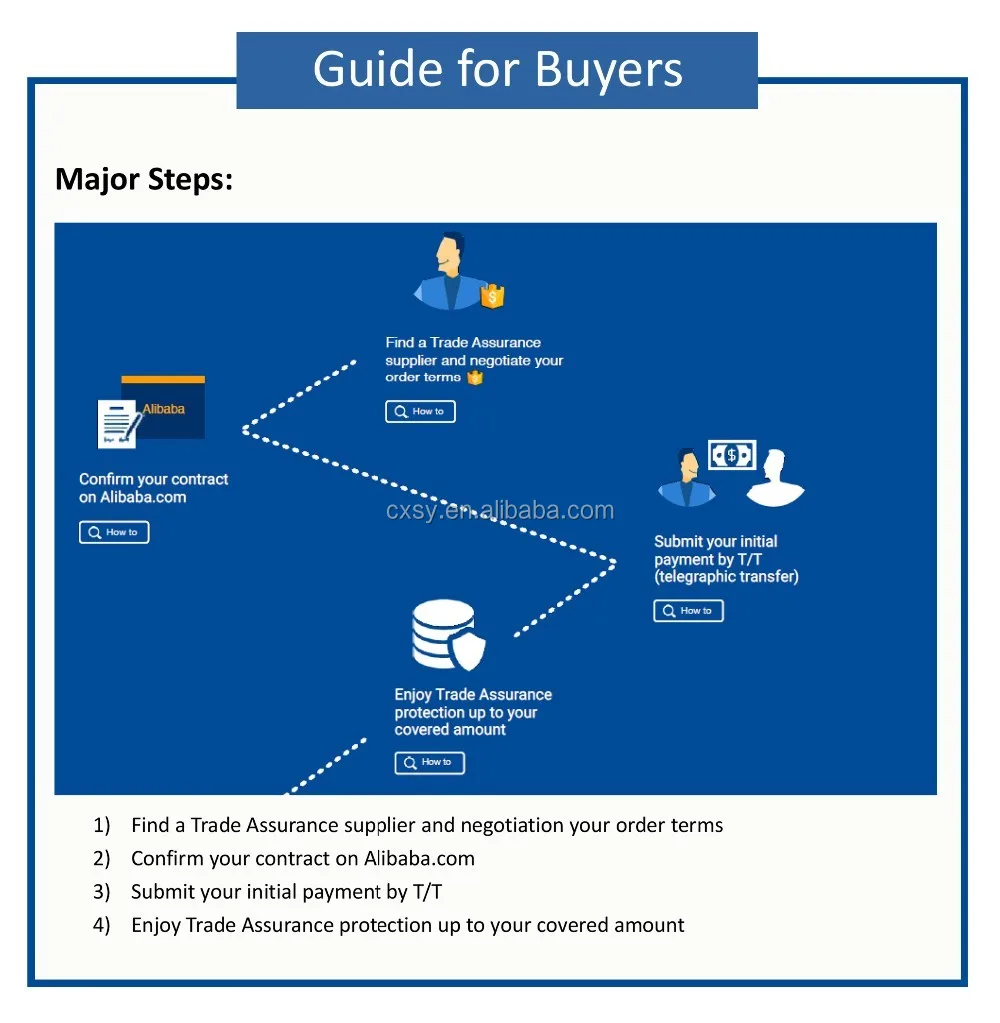

Step 4: Complete the Application

You can apply for a loan through Wells Fargo’s website or by visiting a local branch. The online application is user-friendly and allows you to fill out your information at your convenience. Be prepared to provide details about your financial situation, loan amount, and purpose of the loan.

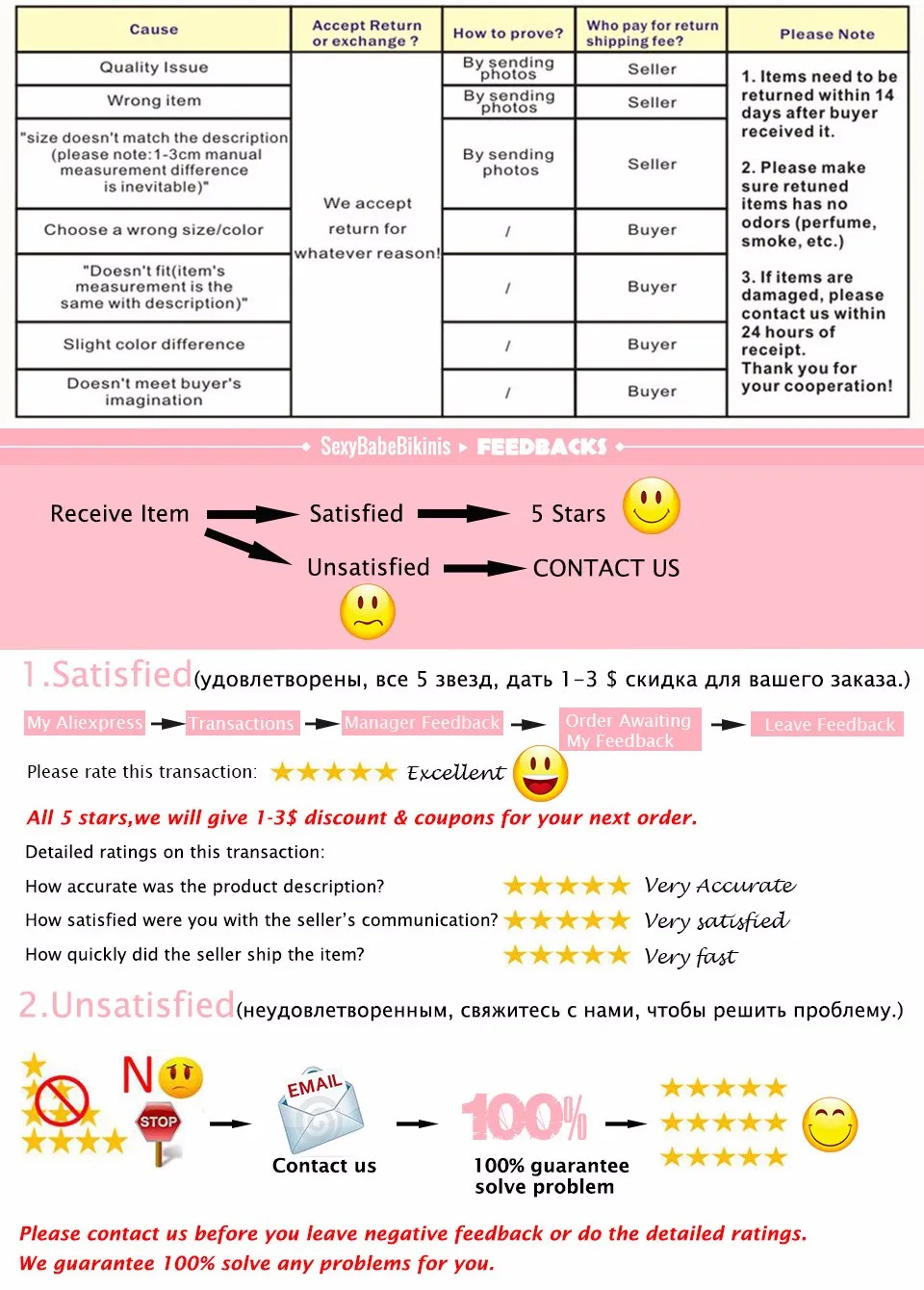

Step 5: Review Loan Offers

Once your application is submitted, Wells Fargo will review your information and provide loan offers based on your creditworthiness. Take the time to compare the terms, interest rates, and repayment options before making a decision.

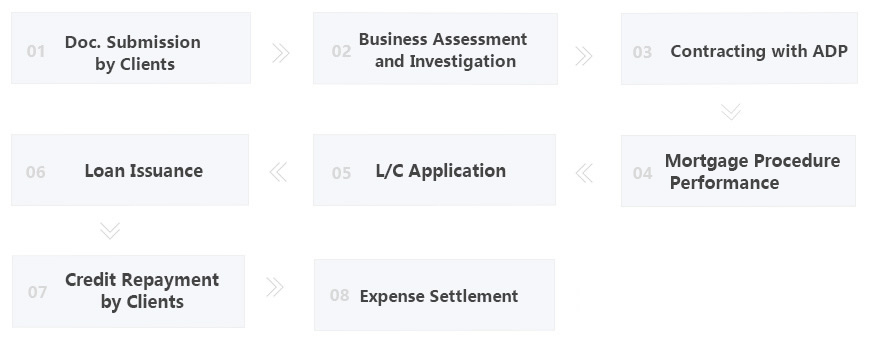

Step 6: Finalize the Loan

After selecting the loan that best fits your needs, you’ll need to finalize the paperwork. This may involve signing contracts and agreeing to the loan terms. Make sure to read everything carefully and ask questions if anything is unclear.

#### Conclusion

Applying for a loan can be a daunting process, but understanding how to **Wells Fargo apply for loan** can make it much easier. By determining your loan type, checking your credit score, gathering necessary documentation, completing the application, reviewing offers, and finalizing the loan, you can navigate the process with confidence. With Wells Fargo's support, you can secure the funding you need for your financial goals.