"Ultimate Guide to Using a Loan Calculator for Personal Loans in India: Maximize Your Borrowing Potential"

#### Loan Calculator Personal Loan IndiaIn today's fast-paced financial landscape, understanding how to effectively manage your finances is crucial. One of……

#### Loan Calculator Personal Loan India

In today's fast-paced financial landscape, understanding how to effectively manage your finances is crucial. One of the key tools that can aid you in this journey is a *loan calculator for personal loans in India*. This tool allows potential borrowers to estimate their monthly repayments, total interest payable, and the overall cost of the loan. Whether you are looking to finance a new car, fund a wedding, or consolidate existing debts, utilizing a loan calculator can help you make informed financial decisions.

#### Understanding Personal Loans

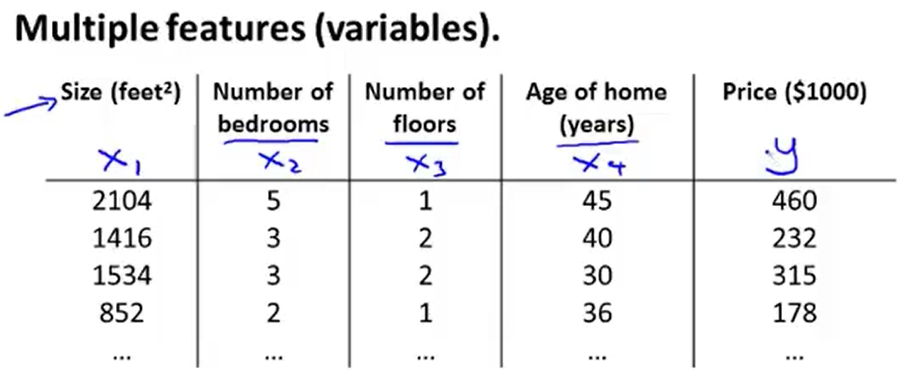

Personal loans are unsecured loans that can be utilized for various purposes, from medical emergencies to home renovations. Unlike secured loans, personal loans do not require collateral, which makes them an attractive option for many borrowers. However, because they are unsecured, lenders often charge higher interest rates compared to secured loans. This is where a loan calculator becomes invaluable; it allows you to see how different interest rates and loan tenures affect your monthly payments.

#### The Importance of a Loan Calculator

Using a *loan calculator for personal loans in India* can save you both time and money. It provides a clear picture of what your financial commitments will look like, allowing you to budget accordingly. By inputting various loan amounts, interest rates, and tenures, you can compare different loan offers and choose the one that best fits your financial situation. This level of transparency can prevent you from falling into debt traps or agreeing to unfavorable loan terms.

#### How to Use a Loan Calculator

To effectively use a loan calculator, follow these simple steps:

1. **Input the Loan Amount**: Start by entering the amount you wish to borrow. Consider your needs and ensure you are not borrowing more than you can afford to repay.

2. **Select the Interest Rate**: The interest rate can vary based on your credit score and the lender's policies. Research current rates to find a realistic figure for your calculations.

3. **Choose the Loan Tenure**: Decide how long you wish to take to repay the loan. A longer tenure may result in lower monthly payments but can increase the total interest paid over the life of the loan.

4. **Calculate**: Once you've entered all the necessary details, hit the calculate button. The loan calculator will provide you with your monthly EMI (Equated Monthly Installment), total interest payable, and the total amount payable.

#### Benefits of Using a Loan Calculator

1. **Financial Clarity**: A loan calculator gives you a clear understanding of your financial obligations, helping you plan your budget better.

2. **Comparison Shopping**: With the ability to input different interest rates and tenures, you can easily compare offers from various lenders to find the best deal.

3. **Avoiding Over-Borrowing**: By visualizing your monthly payments, you can avoid taking on a loan that exceeds your repayment capacity.

4. **Empowerment**: Knowledge is power. Understanding how loans work and using a calculator empowers you to make informed decisions.

#### Conclusion

In conclusion, a *loan calculator for personal loans in India* is an essential tool for anyone considering borrowing. It simplifies the complex process of loan management, allowing you to take control of your financial future. By understanding how to use this tool effectively, you can navigate the personal loan landscape with confidence, ensuring that you make choices that align with your financial goals. Remember, informed decisions lead to better financial health, so take advantage of the resources available to you!