Understanding the Average APR Car Loan: What You Need to Know for Smart Financing

**Average APR Car Loan** (平均汽车贷款年利率)#### Overview of Average APR Car LoanWhen considering financing options for purchasing a vehicle, understanding the **av……

**Average APR Car Loan** (平均汽车贷款年利率)

#### Overview of Average APR Car Loan

When considering financing options for purchasing a vehicle, understanding the **average APR car loan** is crucial. The Annual Percentage Rate (APR) reflects the total cost of borrowing, including interest and fees, expressed as a yearly percentage. This figure can vary significantly based on factors such as credit score, loan term, and lender policies.

#### Factors Influencing Average APR Car Loan Rates

1. **Credit Score**

A borrower’s credit score is one of the most significant determinants of the APR they will receive. Higher credit scores typically yield lower APRs because they indicate a lower risk to lenders. Conversely, individuals with lower credit scores may face higher APRs, making their loans more expensive over time.

2. **Loan Term**

The length of the loan also affects the average APR. Generally, shorter loan terms come with lower interest rates, while longer terms may have higher APRs. However, longer terms can lead to more interest paid over the life of the loan, even if the monthly payments are lower.

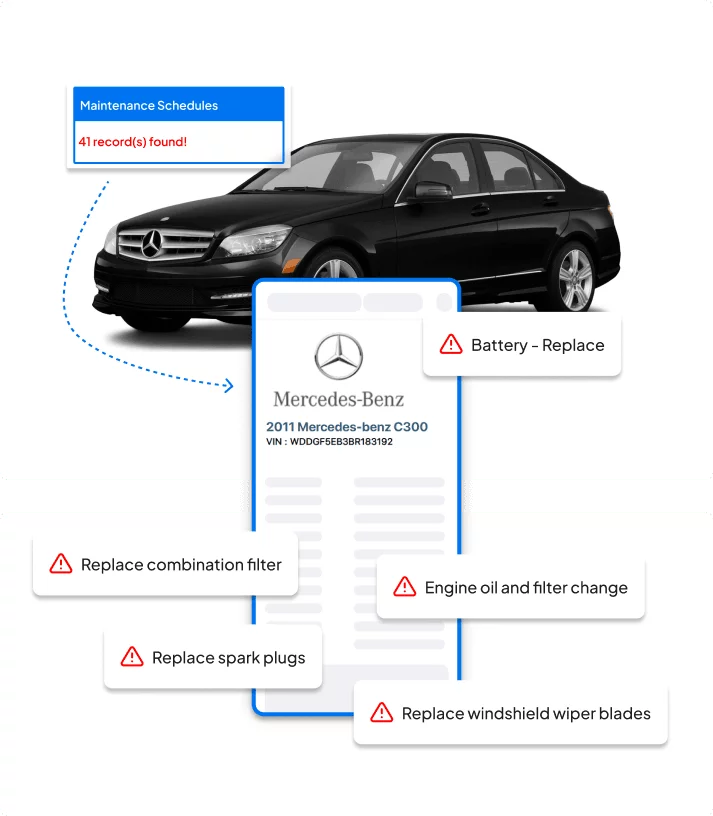

3. **Type of Vehicle**

New cars often have lower APRs compared to used cars. Lenders may offer promotional rates for new vehicles to stimulate sales, which can be beneficial for buyers seeking the best financing options.

4. **Economic Conditions**

The broader economic environment, including the Federal Reserve's interest rate policies, can influence average APRs. When the economy is strong, interest rates may rise, affecting loan rates across the board.

#### Finding the Best Average APR Car Loan

To secure the best **average APR car loan**, borrowers should consider the following steps:

1. **Check Your Credit Report**

Before applying for a loan, it’s essential to review your credit report for errors and understand your credit standing. This knowledge allows you to address any issues that could negatively impact your APR.

2. **Shop Around**

Different lenders offer varying rates and terms. It’s beneficial to compare offers from banks, credit unions, and online lenders to find the most competitive rates.

3. **Consider Pre-Approval**

Obtaining pre-approval from lenders can give you a clearer idea of what APR you qualify for and strengthen your bargaining position at the dealership.

4. **Negotiate**

Don’t hesitate to negotiate the terms of your loan. If you receive a better offer from one lender, use it as leverage with others to potentially secure a lower APR.

#### Conclusion

Understanding the **average APR car loan** is essential for making informed financing decisions. By considering factors such as credit score, loan term, and economic conditions, borrowers can position themselves to secure the best possible rates. Taking the time to shop around and negotiate can lead to significant savings over the life of the loan. Ultimately, being well-informed and proactive in the car loan process can help you drive away with a deal that fits your financial situation.