Understanding Student Loans Loan: A Comprehensive Guide to Financing Your Education

Guide or Summary:Student loans loan are funds borrowed by students to pay for their education expenses. These loans can cover various costs, including tuiti……

Guide or Summary:

#### Student Loans Loan

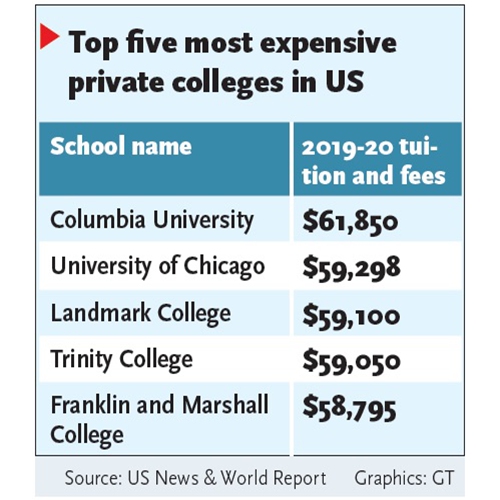

In today's world, pursuing higher education often comes with a hefty price tag. Many students find themselves in need of financial assistance to cover tuition fees, books, and living expenses. This is where student loans loan come into play. These loans are specifically designed to help students finance their education, allowing them to focus on their studies without the constant worry of financial burdens.

#### What Are Student Loans Loan?

Student loans loan are funds borrowed by students to pay for their education expenses. These loans can cover various costs, including tuition, housing, and other related fees. They are typically offered by government programs, private lenders, and educational institutions. The terms and conditions of these loans can vary significantly, making it essential for students to understand their options before borrowing.

#### Types of Student Loans Loan

There are two primary types of student loans loan: federal and private.

1. **Federal Student Loans**: These loans are backed by the government and usually offer lower interest rates and more flexible repayment options. They include Direct Subsidized Loans, Direct Unsubsidized Loans, and PLUS Loans for parents and graduate students.

2. **Private Student Loans**: These loans are offered by banks, credit unions, and other private lenders. They often have higher interest rates and less flexible repayment terms compared to federal loans. Students should carefully compare different lenders and their offerings before committing to a private loan.

#### How to Apply for Student Loans Loan

Applying for student loans loan typically involves several steps:

1. **Fill Out the FAFSA**: The Free Application for Federal Student Aid (FAFSA) is the first step in applying for federal student loans. It helps determine your eligibility for federal financial aid, including grants and loans.

2. **Research Loan Options**: Once you have your FAFSA results, research the different types of federal and private loans available. Consider factors such as interest rates, repayment terms, and any associated fees.

3. **Complete the Loan Application**: For federal loans, you will need to complete a loan agreement and possibly additional forms. For private loans, you must apply directly with the lender.

4. **Accept the Loan Offer**: After your application is approved, you will receive a loan offer. Review the terms carefully and accept the amount you need.

![]()

5. **Attend Loan Counseling**: Many schools require students to complete loan counseling before disbursement. This counseling will help you understand your rights and responsibilities as a borrower.

#### Repaying Student Loans Loan

Once you graduate, leave school, or drop below half-time enrollment, you will enter the repayment phase of your student loans loan. Here are some key points to consider:

1. **Grace Period**: Most federal loans offer a grace period of six months after graduation before you must start making payments.

2. **Repayment Plans**: There are various repayment plans available, including standard, graduated, and income-driven repayment plans. Choose the one that best fits your financial situation.

3. **Loan Forgiveness Programs**: Certain professions, such as teaching or public service, may qualify for loan forgiveness programs. Research these options if you are considering a career in these fields.

4. **Stay Informed**: Keep track of your loans, interest rates, and repayment progress. If you encounter financial difficulties, contact your loan servicer to discuss your options.

#### Conclusion

Navigating the world of student loans loan can be overwhelming, but understanding your options and responsibilities is crucial for managing your education finances effectively. By researching and planning ahead, you can make informed decisions that will help you achieve your academic goals without falling into unmanageable debt. Remember, education is an investment in your future, and student loans loan can be a valuable tool in financing that investment.