Current VA Home Loan Rates: An In-Depth Guide to Securing the Best Mortgage for Veterans

Guide or Summary:Understanding VA Home Loan Interest RatesFactors Influencing VA Home Loan RatesVA Home Loan BenefitsSecuring a home loan is a significant m……

Guide or Summary:

- Understanding VA Home Loan Interest Rates

- Factors Influencing VA Home Loan Rates

- VA Home Loan Benefits

Securing a home loan is a significant milestone for anyone, but for veterans, it often comes with a unique set of benefits. The Veteran Affairs (VA) loan program is designed to help eligible veterans, active-duty service members, and certain surviving spouses achieve homeownership with favorable terms. With the ever-changing landscape of real estate and mortgage rates, staying informed about the current VA home loan rates is crucial for making an informed decision.

In this comprehensive guide, we'll delve into the current state of VA home loan rates, exploring how they compare to conventional mortgages and the factors that influence these rates. We'll also discuss the benefits of the VA loan program, including low down payment options, flexible repayment terms, and no mortgage insurance premiums for eligible borrowers.

Understanding VA Home Loan Interest Rates

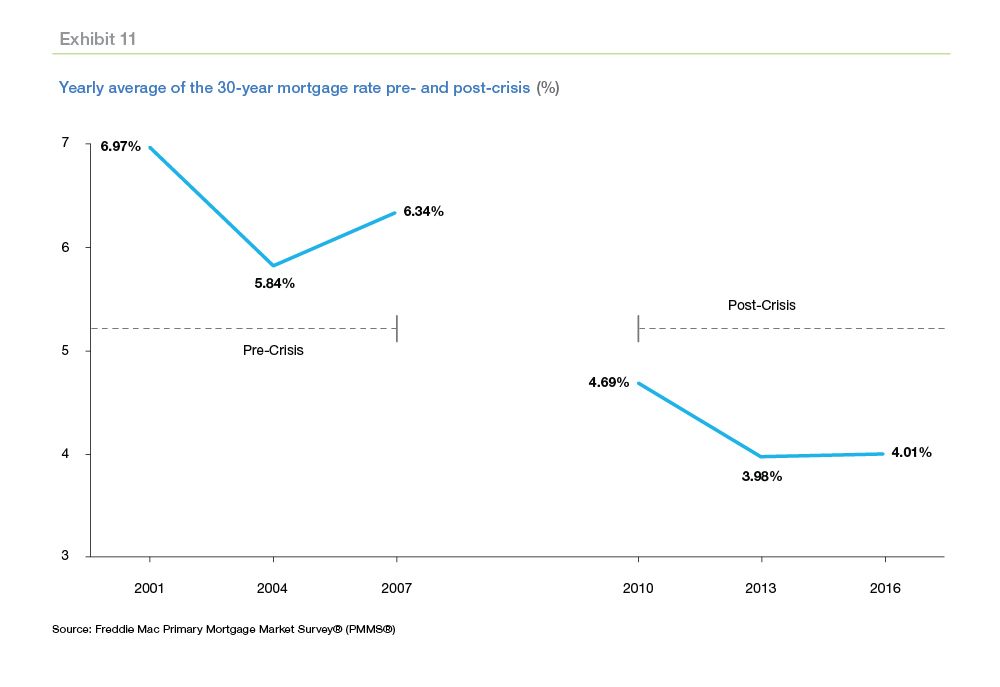

The VA loan interest rates are typically lower than those of conventional mortgages, reflecting the government's commitment to supporting veterans in their homeownership journey. These rates are determined by the current market conditions and the borrower's creditworthiness. As of the time of writing, the average VA interest rate for a 30-year fixed-rate mortgage is around 2.5%, which is significantly lower than the average rate for conventional mortgages.

Factors Influencing VA Home Loan Rates

Several factors can affect VA home loan rates, including the borrower's credit score, the loan amount, and the type of mortgage selected. Generally, borrowers with higher credit scores qualify for lower interest rates, while those with lower scores may face higher rates. Additionally, the loan amount can impact the interest rate, with larger loans often requiring higher interest rates to compensate for the increased risk.

VA Home Loan Benefits

One of the most appealing aspects of the VA loan program is the flexibility it offers. Eligible borrowers can choose between a fixed-rate or adjustable-rate mortgage, depending on their financial goals and risk tolerance. Another significant benefit is the low down payment requirement, which can make homeownership more accessible to veterans with limited savings.

Furthermore, VA loans offer attractive repayment terms, including the option to pay off the loan in 15, 20, or 30 years. This flexibility can help borrowers manage their monthly payments and reduce their overall interest costs over the life of the loan.

In conclusion, the current VA home loan rates offer a compelling opportunity for eligible veterans to achieve homeownership with favorable terms. By understanding the factors that influence these rates and the benefits of the VA loan program, borrowers can make informed decisions that align with their financial goals and long-term plans. Whether you're just starting your homeownership journey or considering refinancing, the VA loan program is a valuable resource for veterans seeking to build equity and create a stable foundation for their future.

As with any financial decision, it's essential to consult with a mortgage professional who can provide personalized advice based on your unique circumstances. By doing so, you can navigate the complex world of home loans with confidence, knowing that you're taking advantage of the benefits that are specifically designed for you as a veteran.