with boat loan refinancing, optimized for SEO:

"Unlocking Your Dream Boat: A Comprehensive Guide to Refinancing Your Boat Loan for Better Terms and Savings"And here's a detailed English description……

"Unlocking Your Dream Boat: A Comprehensive Guide to Refinancing Your Boat Loan for Better Terms and Savings"

And here's a detailed English description:

---

**Unlocking Your Dream Boat: A Comprehensive Guide to Refinancing Your Boat Loan for Better Terms and Savings**

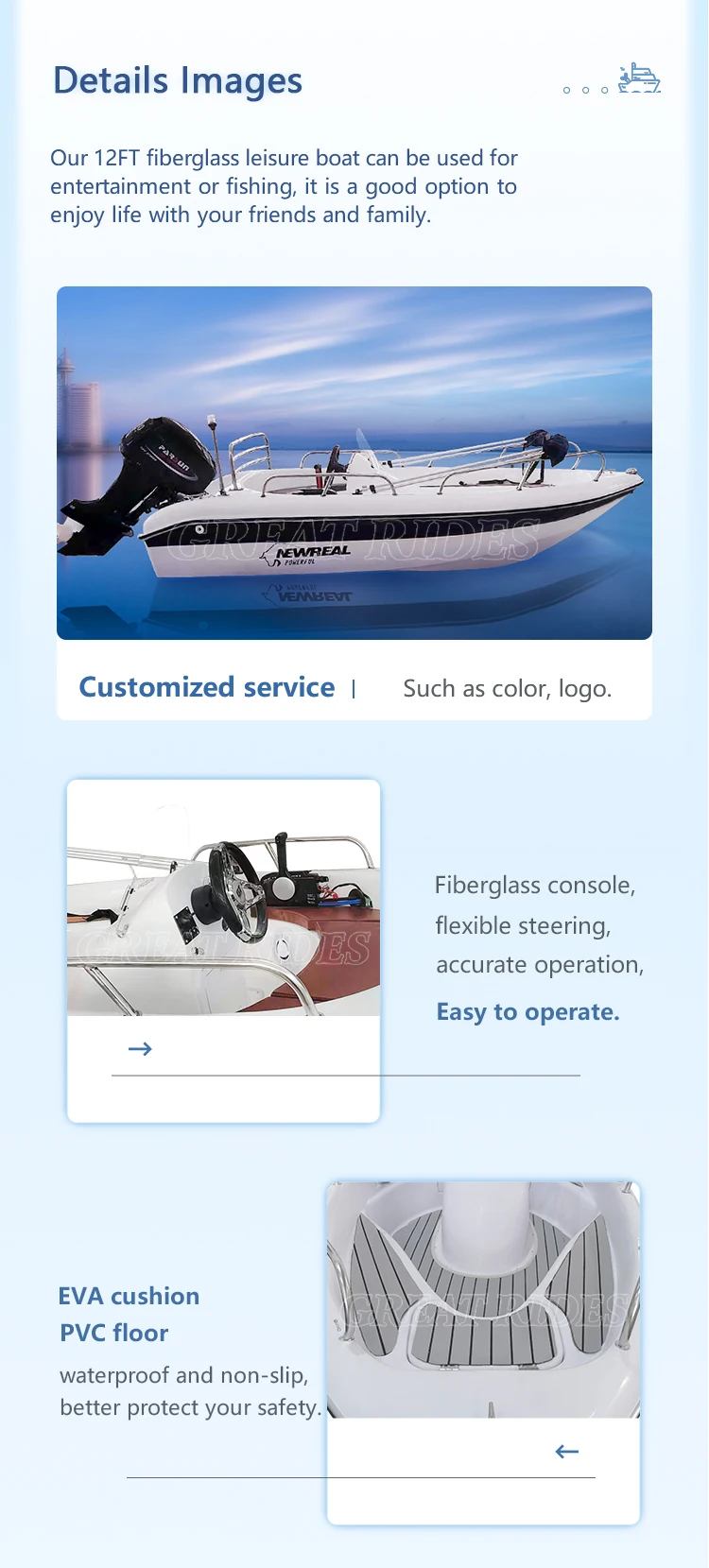

Whether you're cruising the open waters or soaking up the sun on a serene lake, owning a boat can be a dream come true. However, the initial purchase can be a significant financial commitment, often requiring a boat loan to make it possible. Over time, market conditions, and personal financial situations can change, making it beneficial to explore boat loan refinancing options. This comprehensive guide delves into the intricacies of boat loan refinancing, helping you secure better terms, reduce interest rates, and save money in the long run.

**Why Refinance Your Boat Loan?**

Before diving into the process, it's crucial to understand why boat loan refinancing is worthwhile. Here are some compelling reasons:

1. **Lower Interest Rates:** The boat loan market can fluctuate, and refinancing at the right time can secure a lower interest rate, significantly reducing your monthly payments and overall interest paid over the life of the loan.

2. **Extended Loan Terms:** Sometimes, refinancing can extend the repayment period of your boat loan, making your monthly payments more manageable and reducing the total interest paid over time.

3. **Improved Terms and Conditions:** You may be able to negotiate better terms, such as prepayment penalties or fees, which can help you save money and streamline the repayment process.

4. **Tax Benefits:** In some cases, refinancing your boat loan can unlock tax benefits, such as deductions for interest paid, which can further reduce your overall financial burden.

**The Refinancing Process**

Refinancing your boat loan involves several steps, but with careful planning and research, you can navigate this process successfully. Here's a breakdown of what to expect:

1. **Assess Your Current Loan:** Start by reviewing your current boat loan to understand the interest rate, terms, and any fees associated with the loan. This information will serve as a benchmark for comparing offers from different lenders.

2. **Shop Around for Lenders:** Once you have a clear understanding of your current loan, it's time to shop around for potential lenders. Look for reputable lenders that specialize in boat loans and compare their rates, terms, and conditions.

3. **Submit Your Application:** With a list of potential lenders in hand, you can begin the application process. This typically involves submitting financial documents, such as your income, credit score, and proof of boat ownership.

4. **Negotiate Terms:** If you receive multiple offers, take the time to carefully review and compare them. Don't hesitate to negotiate with lenders to secure the best terms possible, including a lower interest rate or extended repayment period.

5. **Complete the Refinancing Process:** Once you've chosen the best offer, you'll need to complete the refinancing process. This may involve signing new loan documents, paying any closing costs, and arranging for the transfer of your boat loan to the new lender.

**Conclusion**

Refinancing your boat loan can be a smart financial move, offering numerous benefits that can help you save money and improve your overall financial situation. By understanding the process and taking the time to shop around for the best offers, you can secure better terms and conditions, making boat ownership more affordable and enjoyable. So, why not unlock your dream boat and explore the world from the comfort of your own vessel? With the right refinancing strategy, it's closer than ever.