Eagle Loans: Your Ultimate Guide to Fast and Flexible Financing Solutions

Guide or Summary:Eagle Loans is known for its commitment to customer satisfaction and transparency. The application process is designed to be user-friendly……

Guide or Summary:

#### Description:

In today's fast-paced world, financial needs can arise unexpectedly, and having access to quick and reliable funding is essential. This is where Eagle Loans comes into play, offering a variety of financing solutions tailored to meet your unique needs. Whether you are facing an emergency expense, planning a significant purchase, or looking to consolidate debt, Eagle Loans provides an efficient and straightforward way to secure the funds you need without the hassle of traditional banking processes.

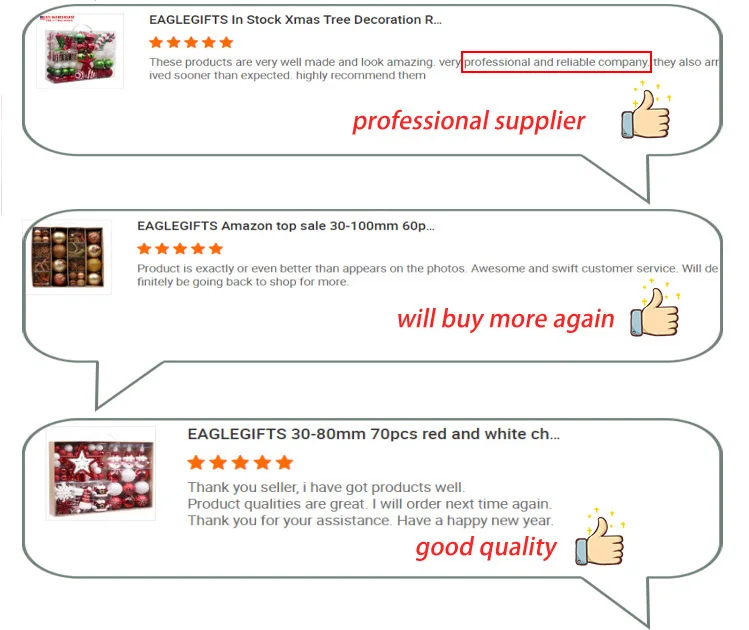

Eagle Loans is known for its commitment to customer satisfaction and transparency. The application process is designed to be user-friendly, allowing individuals to apply online or in-person with minimal documentation. This approach not only saves time but also reduces the stress often associated with securing a loan. With Eagle Loans, you can expect a quick response and a straightforward approval process, making it easier than ever to get the financial assistance you need.

One of the standout features of Eagle Loans is the variety of loan options available. Whether you need a personal loan, a payday loan, or a title loan, Eagle Loans has you covered. Personal loans can be utilized for a wide range of purposes, from medical expenses to home improvements. Payday loans are designed for short-term financial needs, providing quick access to cash until your next paycheck arrives. Title loans allow you to leverage the equity in your vehicle, providing a larger loan amount based on its value.

Understanding the terms and conditions of any loan is crucial, and Eagle Loans prioritizes transparency in its lending practices. Borrowers are provided with clear information regarding interest rates, repayment terms, and any associated fees. This commitment to transparency ensures that customers can make informed decisions about their financial options without hidden surprises down the line.

Another significant advantage of Eagle Loans is the flexibility it offers. With various repayment options available, borrowers can choose a plan that fits their financial situation. Whether you prefer to make weekly, bi-weekly, or monthly payments, Eagle Loans aims to accommodate your preferences. This flexibility is especially beneficial for those who may have fluctuating incomes or unexpected expenses.

Moreover, Eagle Loans understands that financial challenges can affect anyone, regardless of their credit history. That’s why they offer loans to individuals with less-than-perfect credit. While traditional lenders may shy away from those with poor credit scores, Eagle Loans takes a more inclusive approach, assessing each application on its individual merits. This means that even if you have faced financial difficulties in the past, you may still qualify for a loan that can help you regain your financial footing.

Customer service is another pillar of Eagle Loans’s success. The dedicated team of loan specialists is available to assist you throughout the application process and beyond. Whether you have questions about your loan terms, need assistance with repayments, or want to explore additional financing options, the friendly and knowledgeable staff at Eagle Loans is ready to help.

In conclusion, Eagle Loans stands out as a reliable and customer-focused lending option for those in need of quick and flexible financial solutions. With a range of loan products, transparent terms, and a commitment to customer service, Eagle Loans is dedicated to helping individuals navigate their financial challenges effectively. If you find yourself in need of funds, consider Eagle Loans as your go-to resource for fast and accessible financing. Explore your options today and take the first step towards achieving your financial goals with confidence.