Unlocking Homeownership: Your Comprehensive Guide to Indiana USDA Rural Home Loan

#### Indiana USDA Rural Home LoanThe Indiana USDA Rural Home Loan program is a fantastic opportunity for eligible homebuyers looking to purchase a home in r……

#### Indiana USDA Rural Home Loan

The Indiana USDA Rural Home Loan program is a fantastic opportunity for eligible homebuyers looking to purchase a home in rural areas of Indiana. This government-backed loan program is designed to promote homeownership in less densely populated regions by providing affordable financing options.

#### Benefits of Indiana USDA Rural Home Loan

One of the primary benefits of the Indiana USDA Rural Home Loan is that it offers 100% financing, meaning that qualified buyers can purchase a home without a down payment. This is particularly advantageous for first-time homebuyers or those who may not have significant savings. Additionally, the interest rates on these loans are often lower than conventional loans, making monthly payments more manageable.

Another significant advantage is the flexibility in credit requirements. While traditional loans may require a higher credit score, the USDA loan program is more lenient, allowing individuals with lower credit scores to qualify. This opens the door for many who may have previously thought homeownership was out of reach.

#### Eligibility Requirements for Indiana USDA Rural Home Loan

To qualify for an Indiana USDA Rural Home Loan, applicants must meet specific eligibility criteria. Firstly, the property must be located in a designated rural area as defined by the USDA. This means that urban properties do not qualify for this loan program.

Secondly, applicants must meet income requirements, which typically should not exceed 115% of the median income for the area. This ensures that the program assists those who truly need help in achieving homeownership.

Lastly, applicants must demonstrate a reliable source of income and the ability to repay the loan. This can include wages from employment, income from self-employment, or other verifiable sources of income.

#### Application Process for Indiana USDA Rural Home Loan

The application process for the Indiana USDA Rural Home Loan is straightforward but requires careful attention to detail. Prospective buyers should begin by finding a lender who participates in the USDA loan program. Many banks and mortgage companies offer these loans, so it’s essential to shop around for the best terms.

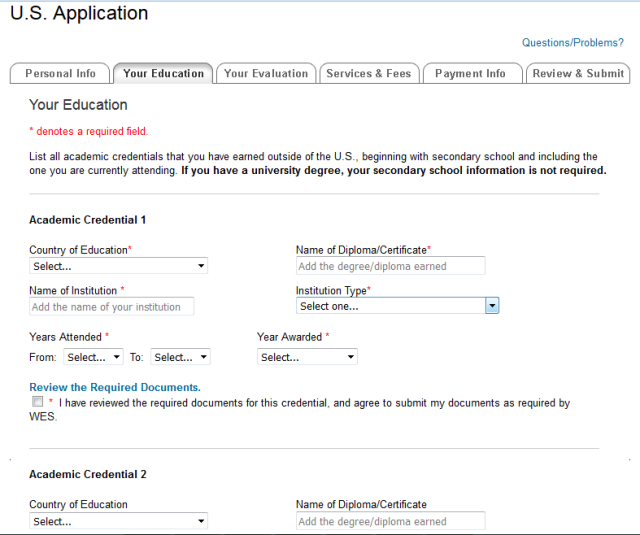

Once a lender is chosen, the next step is to complete a loan application. This will include providing financial information, such as income, debts, and assets, as well as details about the property being purchased. The lender will then review the application and determine eligibility based on the USDA guidelines.

If approved, the next steps involve a home appraisal and underwriting process. The appraisal ensures that the home’s value meets the loan amount, while underwriting assesses the overall risk of lending to the applicant.

#### Conclusion

In conclusion, the Indiana USDA Rural Home Loan program is an excellent resource for individuals and families looking to buy a home in rural Indiana. With benefits such as no down payment, lower interest rates, and flexible credit requirements, this program can make the dream of homeownership a reality for many. By understanding the eligibility requirements and the application process, prospective buyers can take the first steps towards owning their own home in the beautiful rural landscapes of Indiana. Whether you’re a first-time buyer or looking to relocate, the Indiana USDA Rural Home Loan could be the key to unlocking your future.