Unlock Your Dream Home: Discover the Power of a Mortgage Loan Calculator Monthly Payment

Are you dreaming of owning your own home but feeling overwhelmed by the complexities of mortgage calculations? Look no further! With a mortgage loan calcula……

Are you dreaming of owning your own home but feeling overwhelmed by the complexities of mortgage calculations? Look no further! With a mortgage loan calculator monthly payment, you can take control of your financial future and make informed decisions about your home purchase. Understanding how much you can afford and what your monthly payments will be is crucial in the home-buying process.

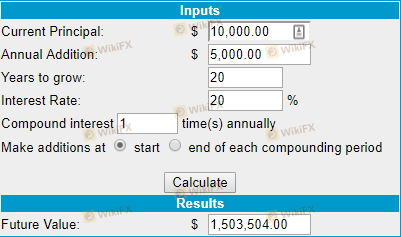

Using a mortgage loan calculator monthly payment is an essential step for anyone looking to buy a home. This powerful tool allows you to input various parameters such as the loan amount, interest rate, and loan term to generate an estimate of your monthly mortgage payments. Not only does this help you budget effectively, but it also gives you a clearer picture of your financial commitment.

Imagine finding your dream home, only to realize that the monthly payments are far beyond what you can afford. By utilizing a mortgage loan calculator monthly payment, you can avoid such pitfalls. It empowers you to play around with different scenarios, helping you understand how changes in the interest rate or loan term can impact your monthly payment. This flexibility is invaluable, especially in today’s fluctuating real estate market.

When you use a mortgage loan calculator monthly payment, you can also factor in additional costs such as property taxes, homeowners insurance, and private mortgage insurance (PMI). These additional expenses can significantly affect your overall monthly payment, and being aware of them upfront will help you prepare financially.

Moreover, the mortgage loan calculator can assist you in determining how much you should save for a down payment. Many lenders require a down payment of 20% of the home’s purchase price, but there are options available for those who may not have that amount saved. By adjusting the down payment percentage in the mortgage loan calculator monthly payment, you can see how it influences your monthly obligations and overall loan amount.

Another advantage of using a mortgage loan calculator monthly payment is that it can help you compare different loan options. With various mortgage products available, it’s essential to understand how each can impact your finances. By inputting details from different loans into the calculator, you can easily see which option offers the best monthly payment, interest rate, and overall cost.

In addition to helping you budget, a mortgage loan calculator monthly payment can also prepare you for discussions with lenders. Armed with the knowledge of what you can afford, you’ll be in a stronger position to negotiate terms and secure the best possible mortgage rate.

In conclusion, a mortgage loan calculator monthly payment is an indispensable tool for potential homebuyers. It not only simplifies the mortgage process but also empowers you to make informed decisions that align with your financial goals. Don’t let the complexities of home financing hold you back from achieving your dream of homeownership. Start using a mortgage loan calculator today and take the first step toward unlocking the door to your new home!