# Unlocking Investment Potential: The Allure of Collateralized Loan Obligation ETF

In the ever-evolving landscape of investment opportunities, Collateralized Loan Obligation ETF stands out as a compelling choice for savvy investors seeking……

In the ever-evolving landscape of investment opportunities, Collateralized Loan Obligation ETF stands out as a compelling choice for savvy investors seeking both yield and diversification. This innovative financial instrument not only offers exposure to a unique asset class but also presents a strategic way to navigate the complexities of the fixed-income market.

## Understanding Collateralized Loan Obligation ETF

At its core, a Collateralized Loan Obligation ETF (CLO ETF) is an exchange-traded fund that invests in a diversified portfolio of collateralized loan obligations. These CLOs are structured financial products backed by a pool of loans, typically made to corporate borrowers with varying credit ratings. By investing in a CLO ETF, investors gain access to a broad spectrum of these loans, which can enhance both yield and risk management.

## Why Choose Collateralized Loan Obligation ETF?

1. **High Yield Potential**: One of the primary attractions of a Collateralized Loan Obligation ETF is the potential for higher yields compared to traditional fixed-income investments. CLOs often offer attractive interest rates, making them appealing to income-focused investors.

2. **Diversification**: Investing in a CLO ETF allows individuals to diversify their portfolios. Since these ETFs hold a variety of loans from different sectors and credit ratings, they can reduce the risk associated with individual loan defaults.

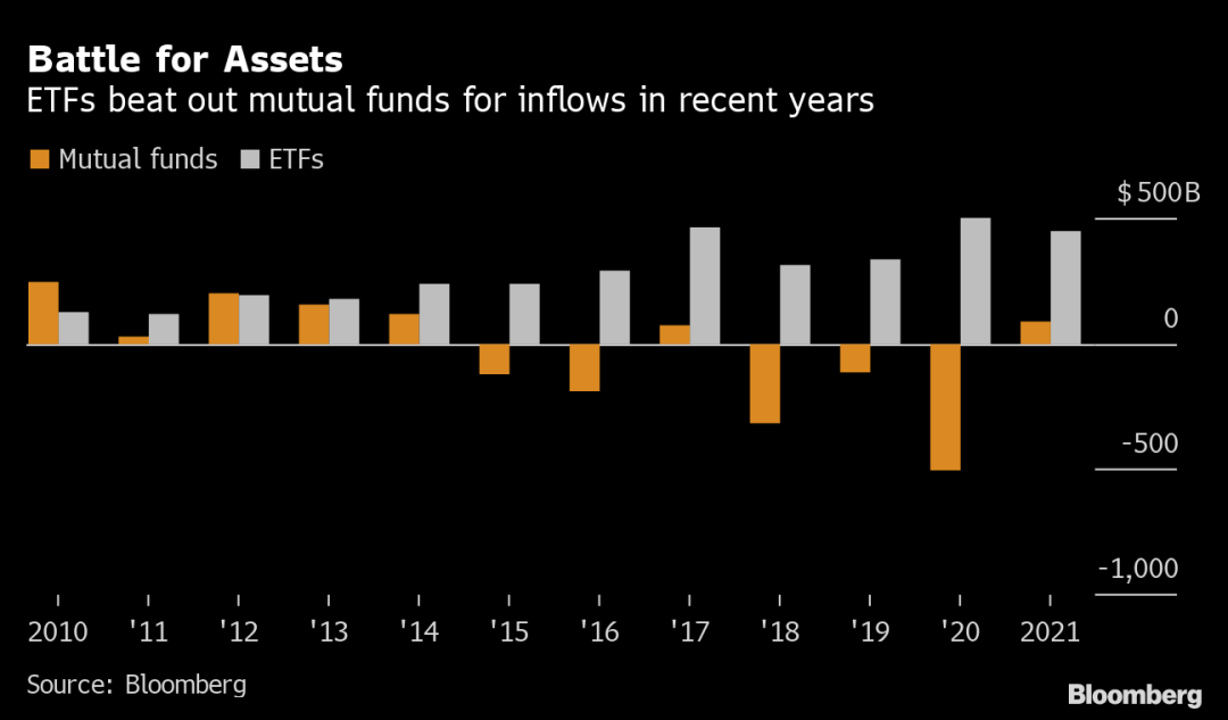

3. **Liquidity**: Unlike direct investments in CLOs, which can be illiquid and complex, CLO ETFs are traded on stock exchanges. This provides investors with the flexibility to buy and sell their shares easily, enhancing liquidity.

4. **Professional Management**: Many CLO ETFs are managed by experienced investment professionals who actively monitor the underlying assets. This expertise can help navigate the complexities of the loan market and optimize returns.

## Risks Associated with Collateralized Loan Obligation ETF

While the benefits are enticing, it’s essential to understand the risks involved. The performance of a Collateralized Loan Obligation ETF is influenced by various factors, including interest rate fluctuations, credit risk, and economic conditions. Investors should conduct thorough research and consider their risk tolerance before diving into this asset class.

## How to Invest in Collateralized Loan Obligation ETF

Investing in a Collateralized Loan Obligation ETF is straightforward. Investors can purchase shares through brokerage accounts, just like they would with stocks or traditional ETFs. It’s advisable to compare different CLO ETFs based on factors such as expense ratios, historical performance, and the quality of the underlying assets.

## Conclusion: The Future of Investing with Collateralized Loan Obligation ETF

In conclusion, the Collateralized Loan Obligation ETF offers a unique blend of yield, diversification, and liquidity, making it an attractive option for investors looking to enhance their portfolios. As the market continues to evolve, staying informed about the dynamics of CLOs and their associated ETFs will be crucial for making sound investment decisions. Whether you're a seasoned investor or a newcomer to the financial world, exploring the potential of a Collateralized Loan Obligation ETF could unlock new avenues for growth and income in your investment strategy.