# Discover the Best Personal Loans Without Origination Fees for Your Financial Needs

Guide or Summary:Personal loans without origination fees are loans that do not charge an initial fee when you take out the loan. Traditional personal loans……

Guide or Summary:

In today's fast-paced world, financial flexibility is essential. Whether you're looking to consolidate debt, make a significant purchase, or cover unexpected expenses, finding the right loan can make all the difference. One of the most attractive options available to borrowers is personal loans without origination fees. These loans not only save you money upfront but also provide you with the financial freedom you need. In this article, we'll explore the benefits of these loans, how to find them, and what to consider before applying.

## What Are Personal Loans Without Origination Fees?

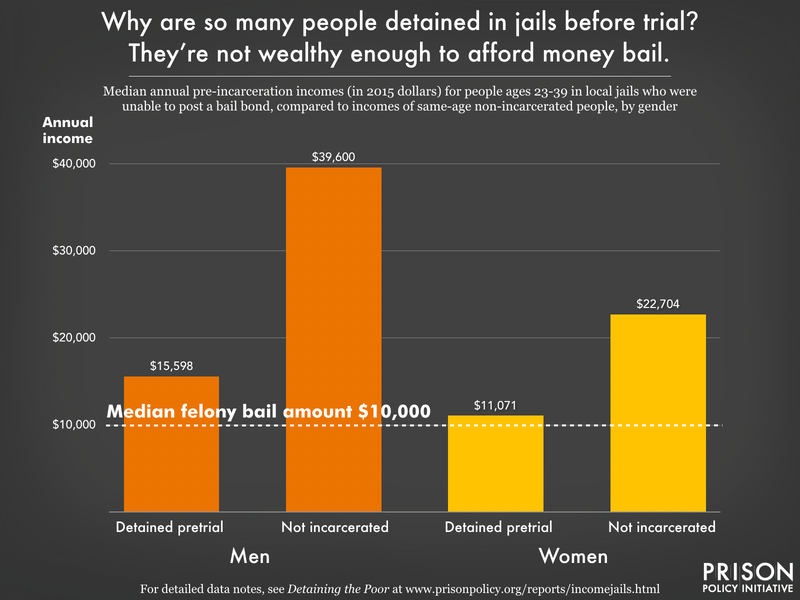

Personal loans without origination fees are loans that do not charge an initial fee when you take out the loan. Traditional personal loans often come with origination fees that can range from 1% to 8% of the total loan amount. This means that if you borrow $10,000, you could end up paying between $100 and $800 just to access the funds. By choosing a loan without these fees, you can keep more money in your pocket.

## Why Choose Personal Loans Without Origination Fees?

1. **Cost Savings**: The most obvious benefit is the savings. Without origination fees, you can use the full amount of your loan for your intended purpose, whether that’s paying off high-interest debt or funding a home improvement project.

2. **Transparent Terms**: Loans without origination fees often come with clearer terms. You won’t have to worry about hidden costs that could catch you off guard.

3. **Easier Approval**: Many lenders offering personal loans without origination fees have streamlined approval processes, making it easier for you to get the funds you need quickly.

4. **Flexible Use**: These loans can typically be used for a variety of purposes, from consolidating debt to financing a wedding or vacation.

## How to Find the Best Personal Loans Without Origination Fees

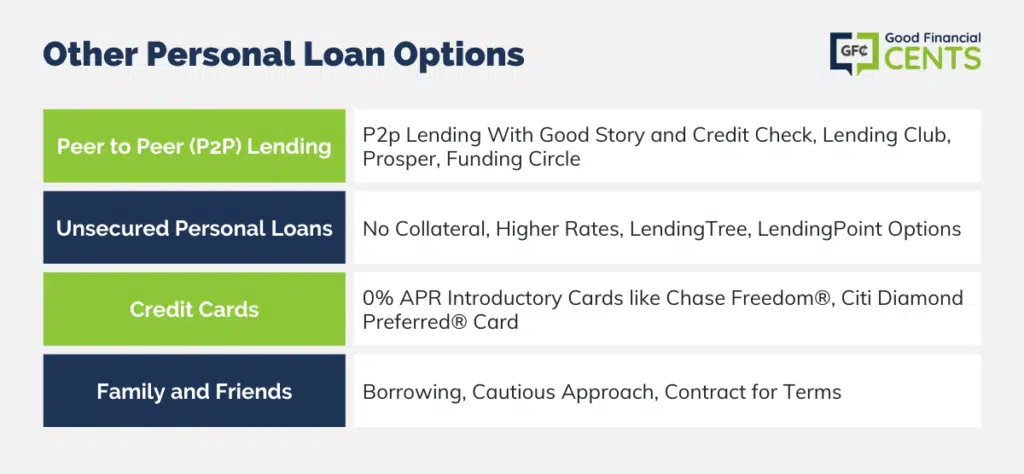

1. **Research Lenders**: Start by researching various lenders. Online platforms often provide a wide range of options and can help you compare rates and terms easily.

2. **Check Reviews**: Look for customer reviews and ratings to gauge the reputation of the lender. This can help you avoid lenders with poor customer service or hidden fees.

3. **Prequalification**: Many lenders offer prequalification, allowing you to see potential rates without affecting your credit score. This step can help you narrow down your options.

4. **Read the Fine Print**: Always read the terms and conditions carefully. Ensure that there are no hidden fees or conditions that could catch you off guard later.

## What to Consider Before Applying for Personal Loans Without Origination Fees

1. **Interest Rates**: While you may save on origination fees, be sure to compare interest rates. A lower fee could come with a higher interest rate, which may cost you more in the long run.

2. **Repayment Terms**: Consider the repayment terms and ensure they fit your budget. Look for loans with flexible terms that allow you to pay off the loan comfortably.

3. **Credit Score**: Your credit score will play a significant role in the interest rates and terms you qualify for. If your score is lower, you may want to focus on improving it before applying.

4. **Loan Amount**: Determine how much you need to borrow. Avoid taking out more than necessary, as this can lead to higher interest payments.

In conclusion, personal loans without origination fees can be a smart financial choice for many borrowers. With the right research and careful consideration, you can find a loan that meets your needs while helping you save money. Whether you're looking to consolidate debt or cover unexpected expenses, these loans offer a compelling solution for achieving your financial goals. Start your journey today and take control of your financial future!