Unlocking Financial Freedom: Allotment Loans for USPS Employees - Your Path to Easy Financing

---### Description:Are you a USPS employee looking for a reliable financial solution? Look no further! **Allotment loans for USPS employees** are designed s……

---

### Description:

Are you a USPS employee looking for a reliable financial solution? Look no further! **Allotment loans for USPS employees** are designed specifically to meet your financial needs with ease and convenience. These loans provide a unique opportunity for postal workers to access funds quickly while enjoying favorable terms and conditions.

**Understanding Allotment Loans**

Allotment loans are a type of personal loan that allows borrowers to repay through automatic deductions from their paycheck. This arrangement is particularly beneficial for USPS employees, who have a stable income and a reliable payment schedule. By opting for an allotment loan, you can secure the funds you need without the stress of missed payments or high-interest rates often associated with traditional loans.

**Why Choose Allotment Loans for USPS Employees?**

One of the main advantages of **allotment loans for USPS employees** is the ease of approval. Since these loans are secured through payroll deductions, lenders view them as lower risk, making it easier for you to qualify even if your credit score isn’t perfect. Additionally, the repayment process is straightforward and hassle-free, allowing you to focus on your work and personal life without worrying about your loan.

**Benefits of Allotment Loans**

1. **Quick Access to Funds:** Whether you need money for unexpected expenses, home repairs, or a special occasion, allotment loans provide quick access to cash.

2. **Competitive Interest Rates:** Compared to other types of loans, allotment loans often come with lower interest rates, saving you money in the long run.

3. **Flexible Loan Amounts:** You can borrow amounts that suit your needs, whether it’s a small loan for minor expenses or a larger sum for significant financial commitments.

4. **Easy Repayment Terms:** With automatic deductions from your paycheck, you can rest assured that your payments will be made on time, eliminating the risk of late fees and penalties.

**How to Apply for Allotment Loans**

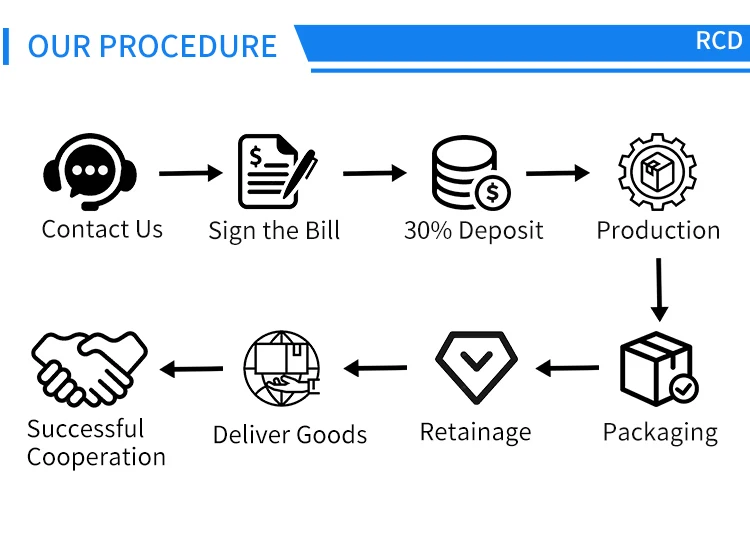

Applying for **allotment loans for USPS employees** is a straightforward process. Here are the steps you need to follow:

1. **Research Lenders:** Look for lenders that specialize in allotment loans for USPS employees. Compare their terms, interest rates, and customer reviews.

2. **Gather Documentation:** Prepare the necessary documents, including proof of employment, income verification, and identification.

3. **Complete the Application:** Fill out the application form with accurate information. Make sure to specify that you are a USPS employee to take advantage of tailored offers.

4. **Review Terms and Conditions:** Before signing, thoroughly review the loan terms, including interest rates, repayment schedule, and any fees associated with the loan.

5. **Receive Your Funds:** Once approved, the funds will be disbursed quickly, often within a few business days.

**Conclusion**

In today’s fast-paced world, having access to quick and reliable financing is crucial, especially for USPS employees who often face unique financial challenges. **Allotment loans for USPS employees** offer a viable solution, providing the financial support you need with manageable repayment options. Take control of your finances today and explore the benefits of allotment loans designed specifically for you. Whether you’re looking to consolidate debt, cover unexpected expenses, or make a significant purchase, these loans can help pave the way toward financial stability and peace of mind. Don’t wait—unlock your financial potential with allotment loans tailored for USPS employees!